As market conditions worsen into 2023, every dollar spent needs justifying.

Nice-to-haves are on pause, so how can you frame your product for a CFO?

Andrew Davies, CMO at Paddle, discusses why your buyer personas have to include the CFO in the environment of every SaaS company and reveals how to do it.

[Transcript] Forget Your Buyer Personas—You Now Serve The CFO

Gary Amaral

Welcome to Hot Takes Live, our marketing stage. I’m Gary Amaral, CMO and co-founder at Breadcrumbs. Thank you so much for joining us today. We are starting the marketing track with a bang! We have Andrew Davies, CMO of Paddle, with us, joining us from the quiet solitude of his vehicle. Andrew, thanks so much for joining. I’ll throw it off to you!

Andrew Davies

Thank you so much, Gary! Welcome, everybody; thanks for joining. Yep, I’m in my car. My kids are home from school at the moment, so this is a nice place of quiet and solitude.

My hot take today is that you can forget all about your buyer personas because you now serve the CFO. My name is Andrew Davies. I’m the CMO of Paddle.com. I’ve got the great joy of being based down in Devon, in the UK. So my only neighbors are cows and sheep.

I was asked for an interesting fact; I don’t know if that qualifies or not, but based over in the UK. Looking forward to having a quick chat with all of you, wherever you are based in the world.

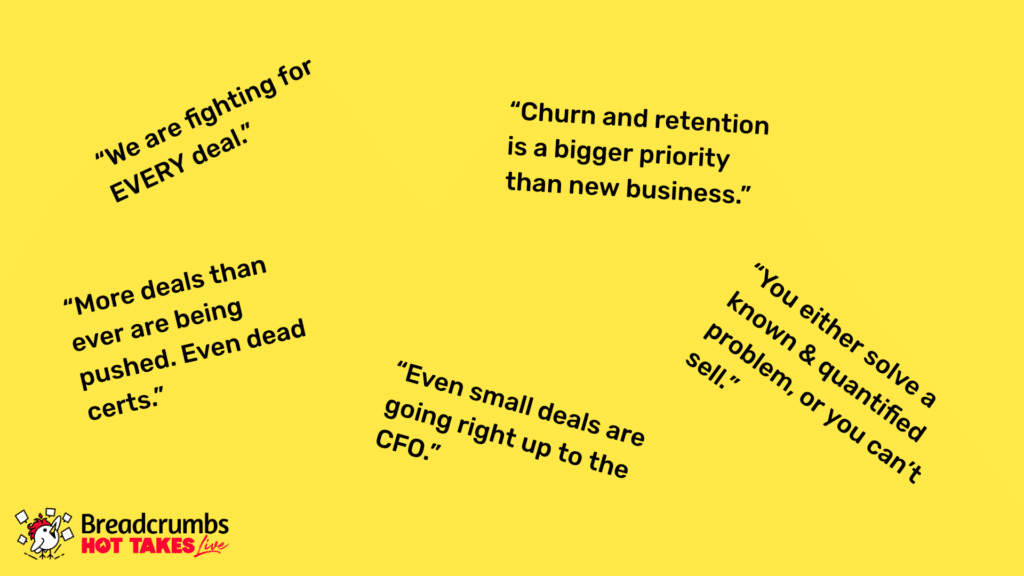

So let’s just dive in. I’m sure we all are seeing the same things. “We are fighting for EVERY deal,” “more deals are being pushed,” “Churn and retention is a bigger priority than new business,” “Even small deals are going right up to the CFO,” and all of these other hot takes coming out of our market.

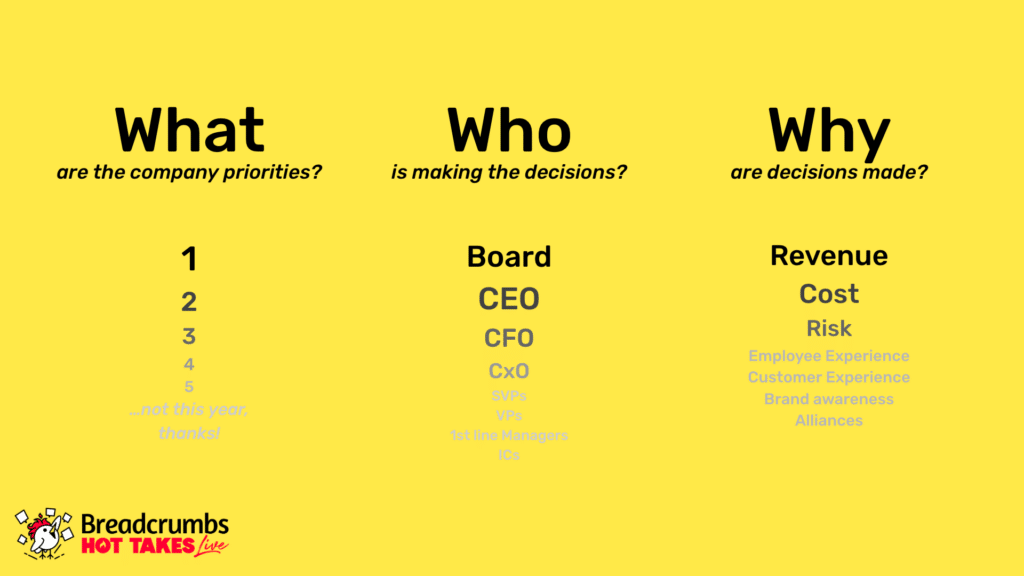

We’re certainly hearing these things; I’m sure you are too. All of my colleagues, CMOs and revenue leaders are hearing the same as well. So what is actually happening? Well, in good times, times we’ve been in for the last few years, you’ve probably got a whole bunch of different priorities in every business, a whole bunch of different people making decisions, and a whole bunch of reasons why those decisions are made. What happens in a difficult economic climate, one that we’re certainly in right now, particularly if you’re in SaaS or selling into SaaS?

Company priorities get very short. The people making the decision that shortlist gets very small. It’s not first-time managers, ICs, and VPs making calls; it goes right up to the CFO, CEO, and the board. The reasons why we make buying decisions also become very short. Suddenly it’s not just about investing in audiences, alliances, customer experiences, and employee experiences. Revenue, Cost, and Risk become the top three things you should focus on. So, your buyer personas have to include the CFO in the environment.

You’ve really got to decide whether you want to start out by including the CFO in the top few personas you go after or whether you want to end up at them. Whether you start with them and then move to other buyers within that committee that you’re selling into, or whether you actually start selling to the person you normally sell to whoever it might be–Head of HR or Head of Marketing–depending on what your product is, and then go to the CFO afterward. They are in your buying group, and you’ve got to make sure you take care of them. So decide whether you’re going to start or whether you’re going to end with the CFO.

Now, marketing loves a good persona book, but everybody’s priorities have changed over the last few months. It’s really a CFO’s world, and we are just living in it. We’ve seen this in all of our research. In our platform, we monitor about 28 billion of ARR, about 30,000 customers that use our metrics product, and about 3,000 customers that use the Paddle billing product.

So we see the go-to-markets of a number of customers, and we are hearing this over and over again. Even the smallest deals are going all the way up to the CFO. So I went back and looked at Sequoia’s latest memo. Back when we went through challenges as Russia invaded Ukraine, and it looked like we were dipping into a recession, Sequoia released one of their famous memos. If you go through about three quarters in, it basically talks about the strategies for uncertain times. Well, simplicity scales; complexity doesn’t. It talks about speed and alignment, but it has this phrase in there that I’ve circled. If it’s not one of these three, it’s fluff:

- Your Product must Drive Revenue Growth

- It Must Save Money

- Must Reduce Risk

Those are the three things that companies are buying for freely, right now.

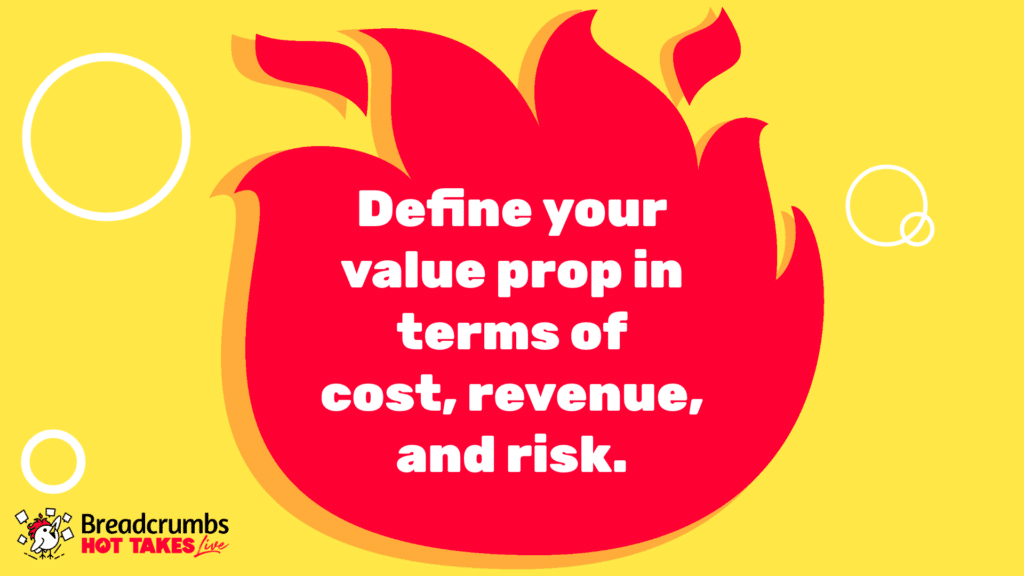

So, second thing: Define your value prop in terms of Cost, Revenue, and Risk because those are the things that aren’t fluff and that people are selling to.

A friend of mine went and did a bunch of interviews with CFOs out of the market to understand what it took to go and sell to a Chief Financial Officer. It’s not rocket science, but it requires clarity. A CFO is not going to piece through all of your complicated verbiage and narrative. They want a strong, value-driven story that they can understand.

So what does this mean? It means that when you talk to a CFO, you need a very clear definition of the problem. You need a very clear analysis of the root cause of that problem. A clear articulation of where you want to get to, and some project milestones, as well as success metrics. It’s not rocket science! Hopefully, most of your pitches have most of that in it already, but when it comes to the CFO, you need all of that, with real transparency and real clarity.

Then, we’ve got the concept of the ROI calculator. Even in good times, many people throw up these ROI calculators, but they can be a bit fluffy, they can be wooly, and they can be very biased toward you as a vendor.

So love them or hate them, someone is going to be doing an ROI calculation in today’s market. So to sell well, you’ve got to make sure there’s a calculator that they can actually control. It’s not just your vendor-side calculator. You’re giving them the Excel spreadsheet that they can dig into and change variables.

Secondly, you’ve got to give complete price transparency as you do that. Don’t try and observocate or keep things behind. Make sure there’s a payback that’s under 12 months. One of the things we are hearing from CFOs in the market is that it’s not just about ROI and value; it’s about Time-to-Value. Make sure there’s an under 12-month payback. Make sure there’s an assessment of the likelihood and the risk of this ROI, and then offer up those big risks. You really win lots of hearts and minds of the CFO community when you’re offering up the problems, the risks, and how you are going to mitigate them.

So, another quick resolution to this hot take, which many people are not yet doing. You’ve got customer case studies coming out of your ears; you’ve got G2 reviews. You need to make sure you grab customer quotes from CFOs to add into those testimonials! When a CFO is reviewing your case study, why shouldn’t it have a quote from someone in the finance department that gives extra credibility to why other customers should use your product?

So go grab customer quotes from CFOs right now, add them onto your web page, add them into your comparison pages, and add them into your customer testimonials. It shouldn’t be too hard to do, and it makes a big difference when you finally get to the CFO for a decision.

Finally, there’s a lot of debate right now about us being in a recession or not. Well, the reality is that it doesn’t matter because your customers think we are, and they’re behaving like we are.

We do a whole bunch in our ‘price intelligently’ division. We’ve got the best SaaS pricing team on the planet. They’ve looked at more pricing data than anyone else on the planet in the SaaS space, and we run polls and panels all the time. I pull this from PC’s – Patrick Campbell – work who’s part of the team and used to lead that team. They did some polling back during peak COVID and saw how before COVID, everybody wanted things that made money, and as soon as COVID hit, everybody wanted things that saves money. We’re seeing exactly the same thing happen again now.

If we go back almost a year, back to March 2022, 27% of the conversion rates were much higher versus 12%, when everyone had a ‘make revenue’ tag within that value prop. Now, the recession fears have made it switch completely from 28% to 6% to save you money. So focus on that value story that saves that CFO money within a 12-month time frame. Find a way of laddering your message back to that.

So what do you need to do with that? Well, you’ve got to go and do the hard work and audit your message everywhere. Go around, work it out in your sales channels, your BDR channels, on your pitch deck, in your customer success messaging, in your email marketing, in anything you’re doing that brand building. What’s on the homepage of your website? Go and audit that message and just do a sense check:

- You should be doing it anyway to see if it’s all coherent!

- See if it’s all laddering up to the same story that’s differentiated and talks about your unfair advantage.

- Is it talking, in context, where we are right now? Is it talking about cost savings, revenue, and risk?

My key takeaway. We’re seeing this across the thousands of customers that we work with, and I think this quote is often misattributed to Charles Darwin: “It’s not the strongest species that survive, nor the most intelligent, but the ones most responsive to change.”

So it doesn’t matter if you haven’t got this right. It doesn’t matter if you are the fastest to get this right, but you’ve got to be responsive to those changes in the market. There will come a brighter day when suddenly the CFO is out of the buying committee again, and suddenly you’re able to focus on revenue growth, employee experience, customer experience, and other things.

For now, make sure you are responsive to the market that we’re in. Focus every bit of your messaging on a CFO who wants complete clarity, who wants a 12-month payback, who wants to understand the calculator, the risks, the mitigation, and who wants to make sure that what they do has a cost-saving built-in.

I’ve been told that I’m allowed to give a one-minute call to action. At Paddle.com, we’ve recently acquired Profitwell, who are the leaders in SaaS pricing and SaaS retention. We would love to jump in and do a free audit with you, whether you want us to audit your pricing strategy and your packaging. Whether you want us to audit your retention strategy and how to save involuntary and voluntary churn, or whether you want us to audit your billing – invoicing or checkout – across the globe, managing all the complexity of subscriptions and tax compliance.

Grab me on LinkedIn: Andrew Davies at Paddle. Just drop me a message or add me. I’ll respond quickly. I’ll make sure I hook you up with an expert who can help you with that audit, free of charge, No Holds Barred, just to give you a bit of insight, hopefully, to help you bounce back quickly and make sure your growth rate is strong in this difficult macroeconomic climate.

Cool, that’s me! I’ve taken my time allotted. Very happy to jump into any questions; otherwise, have a fantastic day!

Hot Takes Live

Replays

Catch the replay of Hot Takes Live, where 30 of the top SaaS leaders across Marketing, Sales, and RevOps revealed some of their most unpopular opinions about their niche.

These leaders shared what lessons they learned and how they disrupted their industry by going against the grain (and achieved better results in the process).

Gary Amaral

Andrew, well done! Thank you so much for that. I have a couple of quick questions for you, if you don’t mind. You’re positioning this as a ‘moment in time’ thing, but when I think about it, I really think that it’s an ongoing shift. You are better off as an organization if you have a compelling financial argument that resonates with the CFO.

Do you think that this is a ‘moment in time’ thing, or do you think this is just a shift in terms of multi-threaded structures of your go-to-market?

Andrew Davies

So, I think it’s a bit of both. Certainly, if you’re selling a decent-sized deal value, you’ll always need to have some form of financial message that goes to a CFO, but that first slide I showed is the most important thing here, which is that we are seeing a significant shortening of the list of people who make decisions right now. The reasons why they make these decisions are shortening too. That financial message is just not relevant. If it’s an individual contributor or someone who is in the business who has budget power but isn’t held to account on EBITD (Earnings Before Interest, Taxes, Depreciation, and Amortization) is making that decision.

It could be based on saving them time, making something easier, or a better user experience. All of those things really count to an individual contributor who’s using your product. So I think it’s a bit of both.

Gary Amaral

Awesome! You know this is all about hot takes and spicy opinions. I agree with you in terms of whether we’re in a recession or not; it doesn’t really matter. The advice gains alone. Out of curiosity, what do you think? Do you think we’re in or going into one?

Andrew Davies

So, as I mentioned, we see a huge amount of SaaS data, and so when it comes to the SaaS Market, that is all I can talk about, because governments can decide the rest of it in terms of macroeconomic climate.

What we have seen and saw very early when the crisis in Ukraine started happening, and inflation started rising in many of the Western economies, consumer churn rose. Once consumer churn started to rise, then new businesses and consumers also started to tail off.

So that was people canceling their Netflix accounts and all those kinds of things, particularly disposable and discretionary type products. B2B always follows. We see that in our data constantly. So, usually, there are longer terms; it’s harder to make those decisions, and they take longer to make. We saw B2B follow a few months later, as churn was increasing and new business was getting harder.

Obviously, it depends on the category of the vertical you’re selling into. Some of them are still really strong, particularly in security, compliance, and financial tools that support a sales team to become more efficient. They are all performing strongly, but we saw that.

The interesting thing is that we saw a second wave of that as we came into the Christmas period. Most people were hoping that the churn that we saw in the summer was going to be most of it, but we’ve definitely seen a second wave as people have started their 2023 financial year.

Gary Amaral

Awesome! Last question. I’m a super fan of Profitwell and Price Intelligently. One of the key messages that they’ve been putting out for years is that most organizations are pricing too conservatively. Does that hold true in the current market?

Andrew Davies

Absolutely! One of the things that’s really interesting is that it is much easier to raise prices and get your existing customers to pay more than it is as a new vendor to sell to that same company. They’ve got an existing infrastructure, incumbent tools, and they’re more likely to double down on those than to bring in new tools to the stack. So, definitely, there’s pricing optimization. It’s not just about charging more, though. It’s about making sure you’re aligning with the value metric, the value that the customer is receiving. Actually, in some cases, we’re seeing some interesting shifts where people are deciding whether to focus on Logo Churn, so saving logos versus Revenue churn.

So, for example, adopting usage-based pricing allows people to churn a bit of the revenue they’re paying you, and so you get paid less, but they stay with you as a customer, and their logo stays with you, so you’ve got more chance of bouncing back later. So that’s a great way of optimizing logo churn over revenue churn, where other companies are making sure that they hold on to every last dollar, and that just depends on your business model.

Gary Amaral

Awesome, Andrew! Thank you so much. Really appreciate you joining us on this edition of Hot Takes Live. Everyone who’s listening, please feel free to take Andrew up on his offer. A huge fan of Paddle, Profitwell, and Price Intelligently. These are great organizations that add tons of value, so please do take him up on that offer. There is a survey in the chat. If you don’t mind taking a moment to fill that out, we would also be appreciative of that.

Andrew Davies

Thanks, Gary!

Gary Amaral

Thank you so much, Andrew; I really appreciate that!