These days, it seems like every VC wants their portfolio companies to create a category. Many seem to think that if you can, you should do it. But, should you? It’s a decision that has big consequences on how you allocate resources.

In this talk, Thomas Shields will share the questions you need to ask to find out if category creation is right for you. You will learn:

- A framework for assessing a category creation strategy

- What most people misunderstand about category creation

- Why investors want you to pursue a category creation strategy even if it isn’t right for your business

[Transcript] Is Category Creation All It’s Cracked Up to Be?

Although transcriptions are generally very accurate, just a friendly reminder that they could sometimes be incomplete or contain errors due to unclear audio or transcription inaccuracies.

Armando Biondi

Here’s the last speaker of the first half of the marketing track. Thomas, welcome.

Thomas Shields

Thank you. No pressure there, and on a strong note.

Armando Biondi

You’re the last one before the break, so keep the energy up. You’re also a returning speaker to Hot Takes Live, by the way.

Thomas Shields

Yes, this is my second one, and this is one of my favorite virtual conferences out there. This one’s great, and I’ve got what I think is a really exciting topic for everyone today–category creation.

Armando Biondi

Let’s jump into that. Is Category Creation all it’s cracked up to be? The floor is yours.

Thomas Shields

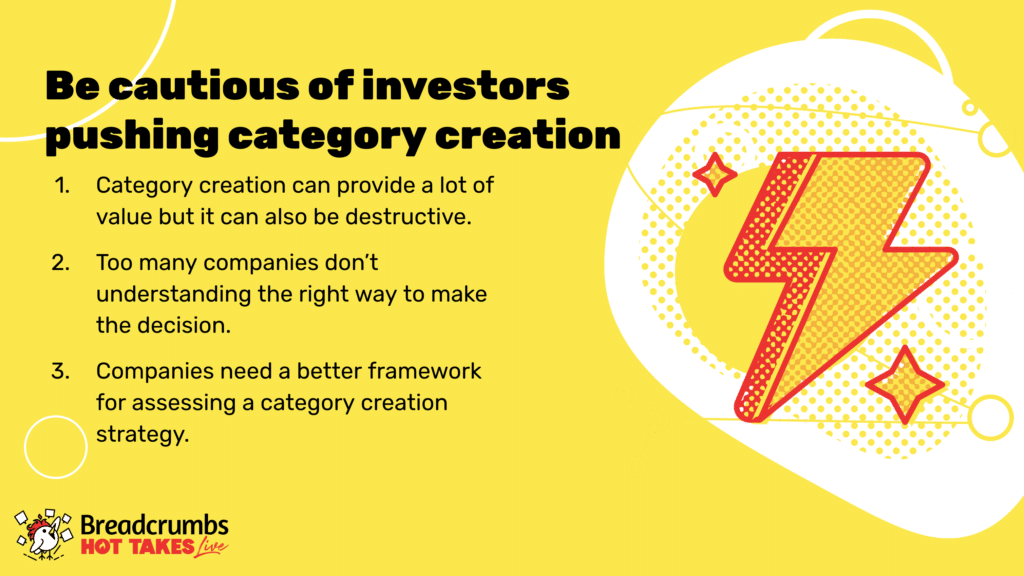

I mean, so I think it is, I don’t know what your experience has been, but my experience has been that it seems like every venture capitalist, every investor at some point wants their portfolio companies to create a category these days, right?

And I think the question, though, is like, we need to explore it, should you? And it’s a decision that carries significant implications for the ultimate success of your business and products, but I don’t think we do a good job of answering ‘should you?’ kind of a basic question.

So that’s what we’re going to dive into today. I’ve got a framework that I’d like to share with you on this topic.

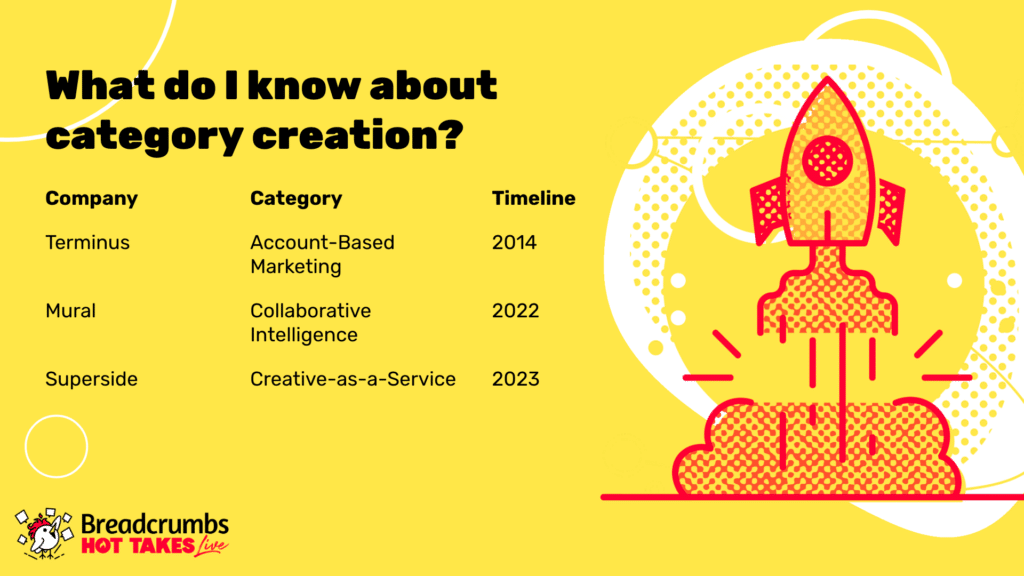

Alright, first slide. So, to introduce myself, my name is Thomas Shields. I’m a product marketing leader with over ten years of experience in the B2B SaaS world.

During my career, I’ve had the privilege, or should I say cursed fortune, no, it’s been really fun, of working with at least three companies that have pursued a category creation strategy, and I’m excited to share what I’ve seen from this experience.

From within these companies, I’ve witnessed tremendous success from category creation and really significant challenges associated with category creation.

The first company I had the opportunity to work on a category creation strategy was this company called Terminus. We played a pivotal role there in transforming account-based marketing into this widely adopted marketing strategy with distinct advantages over this kind of traditional lead-based or inbound marketing approach that has been really popular.

So that was a really successful example of some category creation work that we did, and that drove the growth of the company.

Another company I was at was called Mural, and what we did there was we sought to differentiate ourselves from others in the digital whiteboard market, right? And so, we introduced this category called collaborative intelligence.

Now, while it’s a little early to judge its success, as I was going through the framework here, you’ll find that this one might not be one that’s as successful. Let’s just say it may face some hurdles as a strategy.

Lastly, at Superside, we embarked on category creation by introducing ‘creative as a service,’ and this was an alternative to traditional agencies or freelancer networks as a way to outsource design.

So, I’m going to share my experience here and the framework that I’ve used at these companies to drive success and learn some lessons with category creation.

Alright, so let’s back up for a second. Where does this all come from? Why do people think this?

Back in 2013, there was an HBR article published that showcased that companies that are successfully pursuing a category creation strategy have much higher revenue growth and increased valuations compared to other companies that do not–successful companies that do not pursue the strategy.

The data made the decision seem like a no-brainer for those considering it, and it’s really why investors push it, right? They want companies to take these high-risk, high-outcome strategies.

However, it’s essential to recognize that the data here only compares successful companies. It fails to highlight the increased risk that occurs with pursuing the category creation strategy. The increased risk being that the company will not ultimately succeed, right? And so this sort of bias in the data or the study is called survivorship bias.

Now, on the flip side, many executives, when they’re making this decision, think through, I’ve found, kind of mistakenly focus really solely on the question of ‘do we have the resources and the ability to execute on this?’ and that’s what’s driving the decision.

And that, on the flip side, can leave a lot of opportunities on the table and unrealized. So, we need this better approach. It’s really important to think about this strategy, and that’s what I’m going to share.

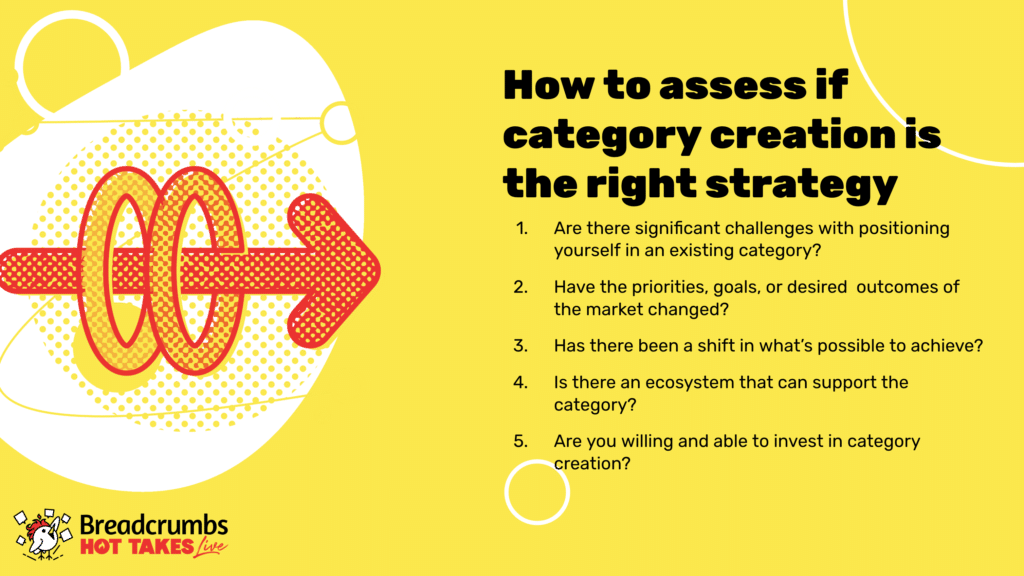

I’m excited that I’ve kind of pulled together the learnings into this framework. It’s five simple questions on how to assess whether you should pursue a category creation strategy. So, diving into it, we’ll go through each one, and hopefully, these will help you really think about the decision for yourself.

So, the first question is, are there significant challenges with positioning yourself in existing markets? You should be coming in with the perspective, “Can I be successful in an existing category?”

And you want to go through and look at the existing markets, and categories that you can position your product in, and ask, “Is this somewhere I think I can be successful?” If you believe that you can win in this market, you should stick with an existing market because there are just inherent benefits.

Audiences will understand what you do faster. It’ll be quicker for them to understand your marketing messages, for them to be well-received, or for people to start acting on them.

As an example, at Superside, we were actually trying to eliminate the idea of doing category creation. But what we found over and over was that our customers faced a lot of confusion, and there was a lot of friction in the sales process when they associated us with being in the agency world or the freelancer networks. So this was a clear sign we needed to consider something different.

The second question is, have there been changes in the market, the target audience, their priorities, goals, or desired outcomes related to a job they’re trying to achieve?

If you can identify a shift in your target audience’s needs or latent problems, this can really help you decide if you should pursue a category-creation strategy.

If the market reality is that something’s changed and the existing categories to solve that problem are not as effective, having a totally different category of solution can really help you stand out and win. And also successfully create a category.

For example, at Superside, we saw this shift happening with the digital revolution that companies have been going through over the past decade. Marketing teams, who are the main users of design work, now place increased importance on speed and volume of design. How much design work can get delivered in a given time is really important.

Why is that important? Because the digital revolution has made it so much easier to go to market, and your speed to market is more important now than ever. There’s been an explosion of experimentation in marketing, so you need an increased volume of design assets.

This change was not being well served by agencies in particular, but also to some degree by freelancer networks. So that was another signal that was really important.

The third question is, has there been a shift in what’s possible to achieve? Has there been an innovation or technological breakthrough that allows you to address latent needs or unsolved needs–things that people didn’t think were possible to solve?

Mural really tried to focus their thinking around category creation here. They wanted to optimize collaboration within companies by providing data on collaboration patterns inside of their company. The question is, is this really something that folks are demanding? Is there a lot of conversation around it?

That leads to the fourth question. Is there an ecosystem that can support the category? This is one of the areas where I feel like I see leaders get tripped up a lot. Category creation is not a solo endeavor. It’s not something you want to go alone.

We’re so used to trying to stand out and be really unique that it clouds our thinking here. But what we want to look for is an ecosystem that we believe exists or can develop around this category.

What does that look like? Well, it can be as simple as customers talking about the category, buying into it, and discussing things online, like the unique challenges they face and how old solutions don’t work as well today.

Also, in a particular B2B context, buyers and customers need to choose between solutions. There may be a mix of solutions that they want to consider to solve the problem.

So, at Terminus, what we did, our strategy was form a consortium of vendors with complementary account-based solutions to really help drive category awareness. This is also where you can start to test the idea of category creation.

We did this at Superside, where we took the idea of “creative as a service,” and we saw that we had a clear consortium. There were clear competitors that would fit in this bucket, and somebody even started talking about some of these ideas that we were talking about.

We put out some content about the category and “creative as a service” as a concept, and we saw that people started buying into it.

They started talking about it. We were looking at mentions of “creative as a service” online as an initial signal that people would buy into this, and we could create an ecosystem around it. So, the influencers are important. People were talking about it; that was a good sign for us.

And then the last question is the question we all know: Are you willing and able to invest in category creation? I think this is one we all know. You know, category creation demands a really strong strategy and use of resources, including human capital. What you need to do is define the market parameters, justify its existence, and ultimately win.

Brute forcing this is really hard unless maybe you’re Apple and you have those kinds of resources. But you need to be really crafty in your strategy to make sure you leverage your resources intelligently. And something that I’ve seen done really well to build that ecosystem. And yeah, that’s a whole topic to dive into for another day.

So, just to sum it up, I think, ultimately, you have to “Prove to customers that a new market category deserves to exist.” April Dunford said this in her book “Obviously Awesome” around positioning. I really liked it. Ultimately, the value of having a new category has to be greater than the value of your solution existing in an established category.

That’s one way to think about it. It might be an unusual idea, but I think you need to really put yourself in your customers’ shoes, understand their needs, and what’s not being solved for them, and think about does a category really help you move faster as a business in terms of convincing customers to buy your product.

So, if you want to discuss this more, I’m on LinkedIn. I’m always happy to talk about this. Feel free to message me or start a conversation, and we can go deeper. I’ll pause there.

Ebook

Ideal Customer Profile (ICP) Worksheet

Learn how to create an Ideal Customer Profile and build a successful sales strategy with this Ideal Customer Profile (ICP) Worksheet.

Armando Biondi

This was awesome, Thomas, thank you so much. If anyone has questions, just write them in the chat, and we take it from there.

It’s funny because category creation feels to me kind of like the latest version of that is PLG, right?

Every company should be PLG; every company should do category creation. Like, wait a second, some people, some operators, and investors push through regardless of everything else.

And one thing thinking about category creation, first and foremost, I wholeheartedly agree with you, by the way, category creation is expensive, right? So you know, think about it twice.

It’s really a compelling framework, the one that you offer, actually, because the expensive part is your last bullet point, right? Like, are you willing and able to invest in making it happen? And then, before that, there is a whole bunch of other stuff that you should think about and consider, right?

Thomas Shields

I think, I mean, that’s where everyone goes, right, it’s expensive, right? And it is expensive, but sometimes making big investments if you’re a small growing company is the right move, and you need to have other questions to know if it is the right move for you.

Armando Biondi

I think it’s an intersection of two dimensions, right? One is expensive, yes, but also needed, right? Do you need to go there versus not so much?

I’m curious. So, one thing that I’m inferring from your framework is that if you have all five bullet points, the answer is yes to each and every one of them, check-check-check, then category creation. But what if you have three?

Thomas Shields

Yeah, that’s a great question. So, it’s not something that if you have a strong signal from everyone, then yeah, the answer is yes. This is where a little bit of the art comes in.

And I think, you know, the first question is incredibly important, right? Can you win in an existing market? The next two kind of come together, right? Is there some significant change that warrants this?

And then I think the fourth question is, is it possible? Can you create this ecosystem? And so I think you need to get a strong signal on one, a strong signal on two or three, a strong signal on four, and then, of course, you need to be able to do it.

I do think you can do it more cheaply than a lot of people assume.

At Terminus, we were not crazy capital-intensive. We were pretty capital-efficient in the way that we went about building up the account-based marketing category.

And we relied on the ecosystem.

Armando Biondi

As a way to gain leverage. To kind of share the burden of establishing the category.

Thomas Shields

Absolutely, absolutely. You have to share the burden. Apple can do that.

So, you have to build an ecosystem of your frenemies, your compliments, influencers in the market, like all of the people out there, which makes it really fun and challenging.

Armando Biondi

One thing I would also say about category creation is that it’s, like, again, every new company likes to think about themselves as category creators. But, to some degree, would you agree with the fact that category creation is rarer than it seems?

Or, is that, if you have to name three, four, or five examples of new category creation endeavors that ended up being successful?

Thomas Shields

So, I think one that’s an interesting kind of market is looking at companies like Gong and SalesLoft. So, Gong kind of has been pushing this idea of Revenue Intelligence.

And early on, I don’t know that I personally was immediately bought into it. I saw their product as really incredibly valuable and powerful, but as they’ve gone on, this is making a lot more sense, and this market has really consolidated into companies like SalesLoft competing with Gong.

Is it a completely new category? Yeah, well, it is a new category, but it’s also kind of like they’ve reformulated maybe a category within sales tools.

So I’m kind of splitting the difference here, but like, people naysayers are like, “Oh, there’s way too much of this,” and then people who are really bullish on it say, “Yeah, like this is the way to go, and you’ll make a lot of money doing it,” and it’s somewhere in the middle.

There are more categories maybe than a lot of the naysayers think,.

Armando Biondi

Also because categories can have different sizes, right? It can be a smaller new category, a bigger new category. So yeah, you might call yourself a category.

The other thing that I find particularly fun is that most companies who want to be monopolists, most investors will say, “You want to have no one to compete with.”

But that is either the outcome of a category creation battle that you want, hence, you know, survivor bias. Or there is no market there. So, how do you judge?

Thomas Shields

Often, you will have competitors. The only time you’re going to be a single player in a category will largely be related if you have really high network effects.

I think looking at Uber and Lyft are a great example, right? Uber’s winning the market, but I feel confident that Lyft’s existence has helped Uber get more and more people to rethink how they’re doing.

Armando Biondi

Uber got their results after, like, 10 years and at least a dozen companies, right?

Thomas Shields

Exactly. I think category transformation is as much category creation as, you know, just pulling a new category out of thin air. That’s what I think Gong has done. And you’re seeing this transformation in the sales tool world, right?

Armando Biondi

All right. This was super interesting and thought-provoking, Thomas. Thank you for that. If people from the audience want to know more, I’m sure you’re easy to reach out to on LinkedIn. Thank you.

Thomas Shields

Awesome, thank you.

Armando Biondi

Thank you so much.