Unkover your competitors’ Marketing Secrets

Say goodbye to wasting hours on competitor analysis by equipping your team with an AI-driven, always-on competitive intelligence platform.

Say goodbye to wasting hours on competitor analysis by equipping your team with an AI-driven, always-on competitive intelligence platform.

Stay Ahead with AI-DRIVEN Competitive Intelligence

Unkover is your AI-driven Competitive Intelligence team delivering critical updates about your competitors the moment they happen:

Track your competitors website changes

Why spend all day stalking the competition when you don’t have to?

With Unkover, you’ll know instantly when your competitors tweak their messaging or shake up their pricing. No more endless scrolling through their sites or second-guessing your strategies.

Let us do the heavy lifting for you, ensuring you’re always in the loop by notifying you the moment a critical change happens on your competitor’s pages.

Sit back, relax, and keep winning—Unkover makes sure you’re not just in the game, you’re always a step ahead.

Read your competitors emails

Companies love updating their customers and prospects about relevant news, product updates, and special offers.

That juicy info from your competitors? It’s yours too. Unkover will automatically capture all their emails and bring them right to your doorstep—accessible to your entire team, anytime.

[COMING SOON: Our fine-tuned AI will sift through these emails, extract key information and send them over to the best team within your org. Less noise, more signal!]

We hear you! Unkover’s goal is not to flood you with tons of data points that no one in your team will ever read. We gather competitive intelligence from thousands of data sources and use AI to highlight actionable information to the right team in your company.

Say goodbye to noise. We’re 100% signal.

ROADMAP

We’re excited to get Unkover in your hands as soon as possible and keep building the best competitive intelligence tool with your precious feedback. The roadmap for the next few months is already exciting, so take a look!

While we build and deliver, here’s our promise to you: as an early tester and customer, you’ll lock in an exclusive bargain price we’ll never offer again in the future.

Spy on your competitors’ full marketing strategy: social, ads, content marketing, email flows, and more.

Track competitive Win/Loss analysis and build battle cards. Get alerted at every pricing change.

Get immediate alerts when competitors announce new features or major releases. Identify strengths and weaknesses from online reviews.

Get the competitive intelligence you need where you need it: Slack, eMail, MS Teams, Salesforce, Hubspot, Pipedrive and more.

slack integration

Unkover’s Slack integration lets you keep your whole team up to speed with your competitors’ updates.

Join now to lock in an exclusive 50% lifetime discount

For startups and small teams, it’s the essential toolkit you need to keep an eye on a select few competitors.

Up to 5 competitors

50 pages monitored

10 email workflows

3-day data refresh

$39

/per month

$ 79

50% discount

Billed annually

For growing businesses, it allows you to monitor more competitors, pages, and email workflows.

Up to 10 competitors

100 pages monitored

20 email workflows

1-day data refresh

$79

/per month

$ 159

50% discount

Billed annually

For large companies, it is tailored to meet the needs of multiple teams needing granular insights.

Custom number of competitors

Custom number of pages monitored

Custom number of email workflows

Hourly data refresh

Custom price

Billed annually

Getting pricing ‘right’ can be extremely difficult and take many iterations as so many considerations need to be taken into account.

Consulting companies, such as ProfitWell (formerly Price Intelligently), recommend having a value metric to base your price on pricing models.

Amy Beaudoin, Senior Director of Product Marketing at Uptempo, will provide a practical example from her own company that explains why this approach doesn’t always make sense depending on your business.

In this session, you will learn:

Massimo Chieruzzi

I’m very happy to introduce Amy Beaudoin, Senior Director of Product Marketing at Uptempo, who’s gonna talk about “Pricing Does Not Need to be Defined by a Value Metric.” So Amy, thank you so much for joining us.

Amy Beaudoin

Well, thank you for having me. I am really happy to be here. So I’m the Senior Director of Product Marketing at Uptempo. We are actually a new brand out in the market. We’re comprised of three companies that have come together, Allocadia, BrandMaker, and Hive9. I’ve been with the company for almost three years, and we provide a marketing operations suite that really helps integrating and planning financial work and performance management.

So just a fun fact, I’m actually from Cobourg, Ontario, which is on the east coast, east of Toronto. I moved out to Vancouver, British Columbia, quite a few years ago because I love mountain biking, so as I said, the mountains were calling. I love everything, the sky that we have here.

And really, the topic of a pricing metric came up when I was doing pricing at my current company, but then also when I was at Hootsuite.

So yeah, we did try to use a value metric for our pricing strategy. We are looking at size of budget or number of budgets.

However, the problem was, when we started doing the research; we did a lot of qualitative research with customers. Every time when I asked, “Hey, what do you think about marketing budget or number of budgets?” none of the value drivers actually resonated with the customers.

So using a value metric that makes sense was counterintuitive as well to encouraging more product usage.

We have a competitor based out of Boston that uses value-based pricing. They’re using size of marketing budgets but in a different market segment.

And a lot of times what we, customers actually and even internally, felt is that, again, it would be counter to the usage of our product, meaning that people wouldn’t use it and put more budgets in because they’re gonna have to spend more money because of that.

So it wasn’t really driving the value we were hoping for.

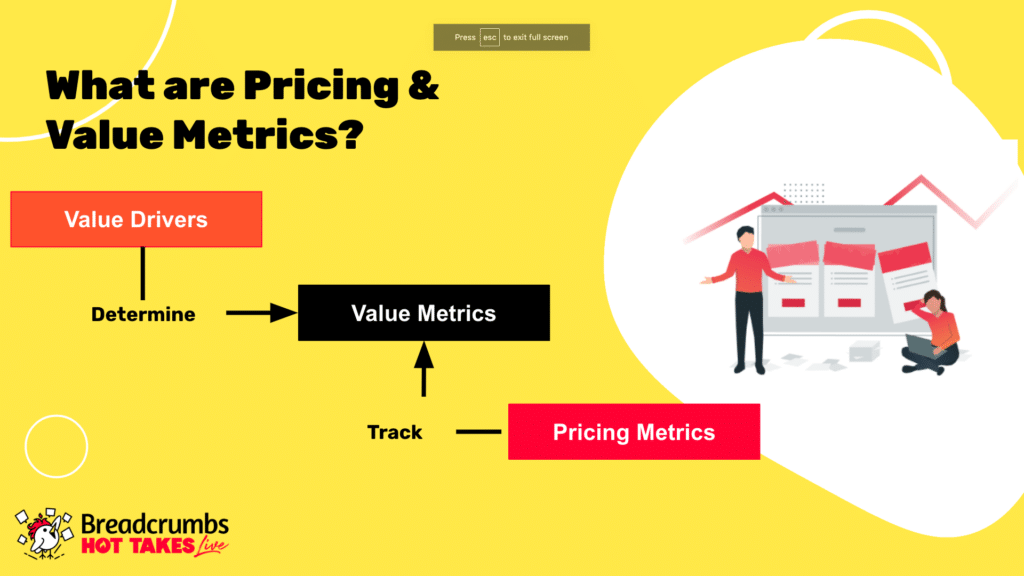

I just wanted to quickly just mention, I think most of you probably know this, but really when you’re looking at the value drivers, that’s what customers really care about. When you’re talking about the value metric itself, it’s about the unit of consumption by which a user gets value.

And then when you’re looking at the metrics themselves, again, these have to sort of align together, but that’s a unit of consumption for which a buyer pays.

So, for example, that could be something I enjoy, like Bulk chocolate by weight or paying for fuel by volume. The tricky part with all of this is coming up with the right value metric.

That’s where things get really quite complicated.

So how do you know if you need a value metric at all? So you should research the value drivers with your customers. Either, if you don’t have enough customers, you can do a qual study, which is what I did. You can also send a quant survey to everyone and find out where they ascribe value.

Ebook

18 Stunning Pricing Page Examples

Get inspired by these 18 stunning pricing page examples and make your pricing page a money-making machine.

One thing that worked really well, too, is just providing mockups of pricing so they could see how you can sort of move from lower stages of maturity up and your packaging structure. And then gather feedback on what they felt as well.

And then really the use cases for the product. If they’re clear, it’s a little bit easier to settle on a value metric for your pricing.

I just wanted to mention Chat GPT as an example; they have over a million users now. They realized 58% of the users wanted a monthly fee per user, 24% said the number of prompts, 12% was the number of tokens, and 7% was other.

So it does sound good, obviously, I think, a lot of times, people just understand that monthly fee per user, but over time, once you understand a little bit more of the use cases, and that’s the same with Chat GPT, then, you can eventually look at sort of a value metric at that point in time.

But sometimes, in the beginning, when you don’t understand those use cases, it’s hard to do that.

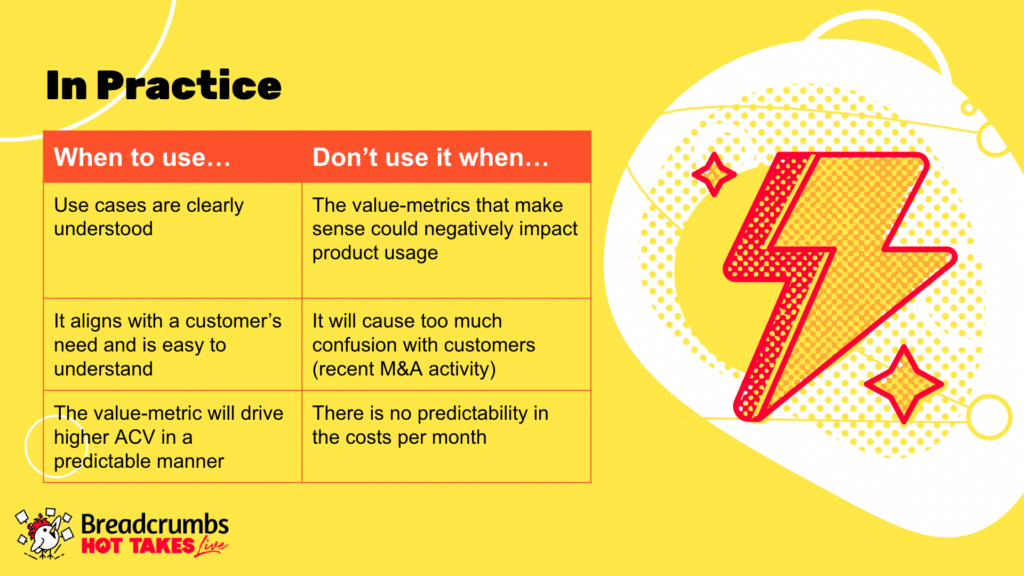

So in practice, when to use it. Again, as I said, use cases are clear. It aligns with the customer’s needs and is easy to understand. The value metric needs to be able to drive your average contract value in a predictable manner.

And then really don’t use it when the value metrics don’t make sense and they negatively impact product usage.

That was the case for us as well. We even looked at it at Hootsuite, looking at the number of social channels, but again, we were concerned that people wouldn’t use the product for that reason if it were gonna cause a lot of confusion.

So that was one thing that we also encountered at Uptempo.

We had the three companies, as I said, coming together. They were all on a per-user-seat license base. And so, to be able to do that for renewals, it was going to be very difficult to try to switch to a value metric. Now that we’re gonna have one platform, I think it’ll be easier going forward, but it just didn’t make sense at the time. We also have a lot of customers that compare us to Salesforce pricing, which, again, is also by seat.

Again, you also need to make sure there’s predictability in the monthly costs.

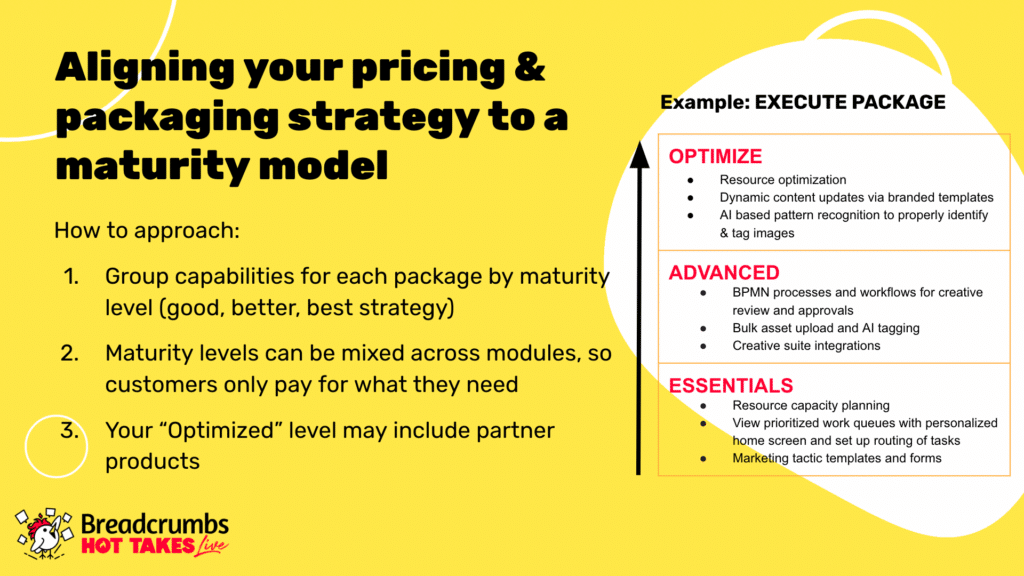

Aligning your pricing and packaging strategy to a maturity model. So I wanted to include this here. These are just our packages; we offer four different packages.

You want to group your capabilities for each package by maturity level, so this is your good, better, best strategy.

We start with Essentials. These are the capabilities you need to execute, and then we kind of go up to Advanced. And then, we have Optimize as your best strategy. Many times, and I know it from when I was at Hootsuite, that would include many partner products.

So, for example, if you wanted advanced listening, in that case, we would add a partner product to it. And then, maturity levels can be mixed across modules. So customers only pay for what they need. So, for example, if they’re really only wanting planning in our case, we’ve got four different pillars that we sell. If they just want planning, they can do that.

And then they can really go what we call sort of deep within a need or across different needs. But they’re only paying for where they’re at right now because they may not be ready for Optimize, yet they may only be at Essentials at this point in time.

So it really helps you with sort of graduating prices and packages along with that.

I know this is a very quick talk here, so I’m going to pause, but essentially, you know when you’ve got it right, this is what John Harrison has said, when you’ve priced it right when your customers are complaining, but they buy anyway.

And again, I just wanted to bring up, too, it is a tricky factor coming up with the value pricing. I’ve worked with Price Intelligently in the past or all around that, but sometimes, for the state of where the business is at, or if you don’t understand enough about where the customer drives value, it may not work at this point in time.

And I’m gonna open it up to questions.

Massimo Chieruzzi

Thanks, Amy. I think pricing is one of the most complex functions of product ever. I always find it challenging, especially when you are a startup I think, most companies just roll the dice or take competitors’ pricing, and they feel they are better at 10-20 percent higher or 10-20 percent lower, which is scary.

I think a great point that I loved is the risk, which I feel very concrete very often, that the more valuable features are the obvious ones for creating paywalls and usage-based pricing. It’s a self-inflicted pain because you have this competition between trying to maximize Revenue, and LTV for a customer. Still, on the other side, you are really risking retention and adoption.

Seat-based pricing is a typical example. I think you want as many people as possible from your customer organization to use your product for attention purposes.

Amy Beaudoin

Yeah, 100%, absolutely. And that’s again where we kind of ran into some issues. We started adding viewer licenses because we wanted more people on our platform, and sometimes we’ll have marketing finance that goes into the platform, but it was the same thing; it was just going to get too complicated.

I was surprised because I thought that the customers were going to say that the complexity is when you have these big budgets and multiple budgets. So that’s where we asked them if there were any other value drivers, and they really just wanted to go back to seat-pricing, which was a bit of a shock.

That’s why when I talked to you guys about what to present, I was like, this is a good one because it was really when you go out there, and you do all the theory on pricing, it’s all around getting the value metric.

If the value metric can be the same as your pricing metric, that’s awesome. But sometimes it can’t be that way, so if you look at Wistia, you know they charge by the number of videos hosted, the amount of bandwidth that the videos take out from a month, so they actually have a dual metric in that case.

If they were looking at what a lot of people do, which is, oh, you’ve got a bare-bones basic license, an enterprise tier, and then something in the middle, everyone would get unlimited bandwidth and videos, so it really wouldn’t make sense. If you’re looking at Disney, they use lots of videos and lots of views. They’d be paying the same thing as someone who doesn’t have a lot of videos.

It can get quite complicated, but at the end of the day, if you can have a value metric, it’s better because then people can tie the value directly back.

But in some cases, it just doesn’t make sense, and again when you’ve got mergers and acquisitions going on and, like you said, you don’t want to lose customers, it would be too hard to try to make that translation to a value metric when you’ve got three pricing models coming together.

Massimo Chieruzzi

Yeah, and probably for companies like Wistia, your cost structure has a lot of impact on pricing.

Maybe you would want to make that feature unlimited, but on the other side, specific features are also strictly tied to your cost structure.

Amy Beaudoin

Exactly, yeah, 100%.

Massimo Chieruzzi

I love the GPT example. Actually, that’s something I wanted to ask you, when doing customer interviews or surveys, what’s the best way to ask for customer feedback about the pricing?

Chat GPT was curious; I just did the survey a couple of weeks ago. Basically, they were asking the same question four times.

They were asking, I don’t remember exactly, but like what you think is the fair price for chat GPT, and the next question was at what point would you consider it expensive, but you’d still buy it, and at what point you will consider it too cheap and be suspicious.

It was basically five questions that I thought was interesting. I’m curious, how do you ask for customer feedback about pricing, knowing that probably their tendency is to stay lower? How do you handle that?

Amy Beaudoin

Yeah, we use the Van Westendorp method as well, though. Actually, it’s around price sensitivity.

I mean, you can still look to see where your competitors are at. I think there are more factors; you can also look at competitors and what they’re at to get a sense of what the market will bear.

Because, as you say, everyone’s going to say, “I want to pay less,” and that’s what they told us, but in our case, they compared us to Salesforce, so you know it’s kind of good, and then you go look at Salesforce pricing to get a rough idea of what that’s at.

But I think when it comes down to it at the end of the day, that’s around willingness to pay. Still, if you can again get a value metric that’s also your pricing metric, then people will see the value, so you’re not arguing over its price, so it really comes down to those things.

I actually think what worked really well, too, was putting the mock-ups with the pricing and what you get. I found that exercise helpful; when I did the research with customers, it really helped because they could visualize, “What do I get in this package? If I advanced my sophistication, then what is the next package what does that look like?”

Then they could see the price difference, but then everything you received. For example, anyone I spoke to from another company said single sign-on, which was huge, and you get surprises; we had a recycle bin that was really highly valued by customers.

But you have to ask it with other things. I did it like a go-to-market survey, and I also asked around the features that they care about I had them rank them, and that also helped us to try to identify if there were any other value drivers here that we could come up with based on what they care about in the product.

Massimo Chieruzzi

Awesome, we still have one minute and 15 seconds; I have one final, super quick question for you.

How do you assess price complexity? I think another friction in deciding pricing is between flexibility for the end user and making it so complex that it’s hard to get a conversion. I remember, at one point, Intercom had 15 options to create your own pricing based on usage, packages, and so on.

Amy Beaudoin

Yeah, so I mean, when we did it, we kept it fairly simple because we were trying to standardize pricing against three platforms. That’s why we aligned it with this maturity model, so we were still looking at per-seat licensing.

If you’re paying for Essentials or Basic, whatever you want to call that package, it would be at a lower rate. Obviously, we look at our costs and everything else to ensure we’re making money, but that’s what we did.

Then we figured out the additional value, and we used a percentage in that case, and I think, in general, it was like one and a half times when you go from one package to another, but again we would check those prices through our research as well.

Then we did it that way if you’re buying more than one package. We’ve got these four different packages, then within them, they go from Essentials all the way to Optimize, so with that, we made sure that we weren’t also going to say like, you know, $900 per user for this one, oh you want to add another one that’s another $900.

We added some price sensitivity there and lowered the price if they bought more than one module. We looked at it from the packaging perspective first and then what would be the right price based on our research.

I know that’s a fairly simple answer right now. It’s a little more complex when you’re doing it by looking at price sensitivity and mapping all those points that you said, but essentially that’s how we did it.

Massimo Chieruzzi

Awesome, Amy, Thank you so much for joining us today.

Amy Beaudoin

Thank you, it was a pleasure being here, and I wish everyone a wonderful rest of your day.