Unkover your competitors’ Marketing Secrets

Say goodbye to wasting hours on competitor analysis by equipping your team with an AI-driven, always-on competitive intelligence platform.

Say goodbye to wasting hours on competitor analysis by equipping your team with an AI-driven, always-on competitive intelligence platform.

Stay Ahead with AI-DRIVEN Competitive Intelligence

Unkover is your AI-driven Competitive Intelligence team delivering critical updates about your competitors the moment they happen:

Track your competitors website changes

Why spend all day stalking the competition when you don’t have to?

With Unkover, you’ll know instantly when your competitors tweak their messaging or shake up their pricing. No more endless scrolling through their sites or second-guessing your strategies.

Let us do the heavy lifting for you, ensuring you’re always in the loop by notifying you the moment a critical change happens on your competitor’s pages.

Sit back, relax, and keep winning—Unkover makes sure you’re not just in the game, you’re always a step ahead.

Read your competitors emails

Companies love updating their customers and prospects about relevant news, product updates, and special offers.

That juicy info from your competitors? It’s yours too. Unkover will automatically capture all their emails and bring them right to your doorstep—accessible to your entire team, anytime.

[COMING SOON: Our fine-tuned AI will sift through these emails, extract key information and send them over to the best team within your org. Less noise, more signal!]

We hear you! Unkover’s goal is not to flood you with tons of data points that no one in your team will ever read. We gather competitive intelligence from thousands of data sources and use AI to highlight actionable information to the right team in your company.

Say goodbye to noise. We’re 100% signal.

ROADMAP

We’re excited to get Unkover in your hands as soon as possible and keep building the best competitive intelligence tool with your precious feedback. The roadmap for the next few months is already exciting, so take a look!

While we build and deliver, here’s our promise to you: as an early tester and customer, you’ll lock in an exclusive bargain price we’ll never offer again in the future.

Spy on your competitors’ full marketing strategy: social, ads, content marketing, email flows, and more.

Track competitive Win/Loss analysis and build battle cards. Get alerted at every pricing change.

Get immediate alerts when competitors announce new features or major releases. Identify strengths and weaknesses from online reviews.

Get the competitive intelligence you need where you need it: Slack, eMail, MS Teams, Salesforce, Hubspot, Pipedrive and more.

slack integration

Unkover’s Slack integration lets you keep your whole team up to speed with your competitors’ updates.

Join now to lock in an exclusive 50% lifetime discount

For startups and small teams, it’s the essential toolkit you need to keep an eye on a select few competitors.

Up to 5 competitors

50 pages monitored

10 email workflows

3-day data refresh

$39

/per month

$ 79

50% discount

Billed annually

For growing businesses, it allows you to monitor more competitors, pages, and email workflows.

Up to 10 competitors

100 pages monitored

20 email workflows

1-day data refresh

$79

/per month

$ 159

50% discount

Billed annually

For large companies, it is tailored to meet the needs of multiple teams needing granular insights.

Custom number of competitors

Custom number of pages monitored

Custom number of email workflows

Hourly data refresh

Custom price

Billed annually

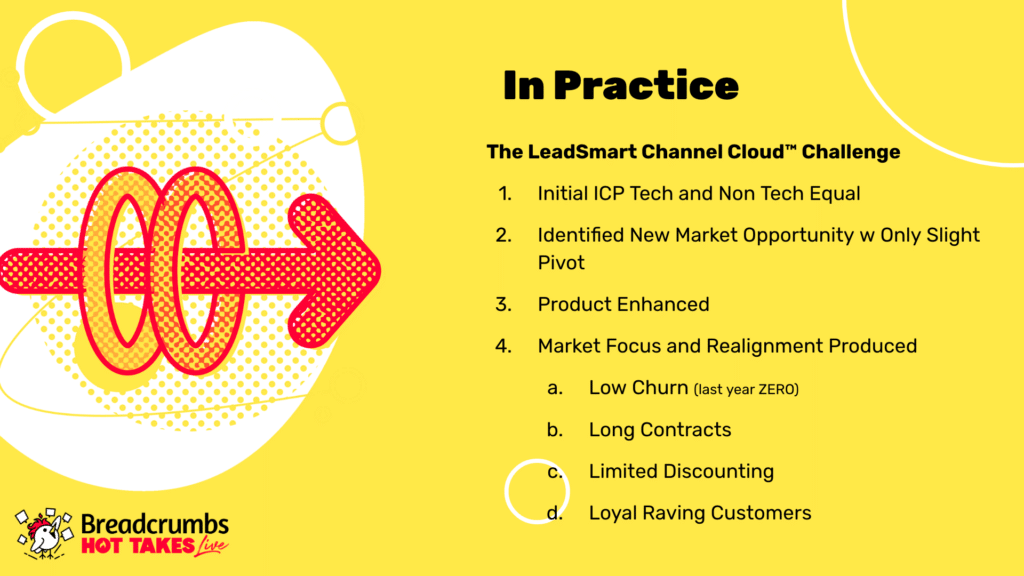

Most B2B SaaS companies are focused on selling to each other. It can be a vicious cycle, but what VCs and most B2B companies are looking for. Expanding horizons into new markets can accelerate growth, LTV, and more.

In this session with Kevin Brown, Co-Founder and CEO at LeadSmart Technologies, you’ll learn:

Although transcriptions are generally very accurate, just a friendly reminder that they could sometimes be incomplete or contain errors due to unclear audio or transcription inaccuracies.

Armando Biondi

We are already midway through Hot Takes Live; the third edition is running its course at this point, the first session of the second half of the marketing track. Kevin Brown, how are you?

Kevin Brown

Fantastic, Armando, how are you today?

Armando Biondi

I’m very good, and I’m very excited to have you. Kevin is the CEO and co-founder at LeadSmart Technologies, and your hot take today is, “Plot Twist: There is life outside of your SaaS ICP.”

Tell us more.

Kevin Brown

Yeah, fantastic. I appreciate that, 1. the invite and 2. everybody being with us today. It’s great.

So, to kind of dive into all of this, as we get started this morning, there’s a little bit about myself. My name is Kevin Brown, I’m the co-founder and CEO of LeadSmart Technologies.

We are what we call a ‘vertical-specific and purpose-built CRM and customer intelligence platform’ using some AI-enabled tools to help our target customers reach out to customers through a channel relationship; I’ll tell you our story on that shortly here as well.

Our focus right now is wholesale distribution and manufacturing to get deep insights into customer relationships in ways that they’ve not traditionally been able to do. So, a little bit about our company. I’ll share more about our journey shortly.

But a couple of interesting facts that we are asked in our deck here to share about ourselves: the first one is a little bit career-oriented, and the second one is personal life somewhat as well.

So I spent the last couple of years after university, my last year of university, and about another seven years afterward working as a reserve firefighter.

Kind of weird to now be a SaaS founder 30-plus years later, but you know the reason I share that is when you’re working as a first responder in life-and-death situations, when people call you to actually go do the important part of your work, it’s usually their worst day of their life.

As you learn how to manage and handle those things within your life, what you quickly find out is how unimportant some things are and how important others are, and that’s translated into my business career to be able to really prioritize things well.

I mentioned I’ve had an opportunity to race sailboats in over four different countries. I’ve been racing sailboats since I was a little boy, and the reason that I mentioned that is that also has brought me tactical decision-making tools in my career.

It delayed my personal life a little bit because I waited till I was 40 years old to get married for the first time, but it’s good because my lovely wife of almost 18, almost 19 years now, Darlene, was married to somebody else first. So glad I waited.

So let’s get in and talk about our main topic here today, which really is that a preface or a thesis that I’ll make and share with you is that the traditional ideal customer profiles can actually hamper revenue growth.

Bold statement, right? Doesn’t mean that that’s the fact for everybody, but for many, it does, and so the reality of this is that most ICPs, ideal customer profiles, are built around the experience of our founders.

Right of our key initial management team, maybe with some input from some of our investors and so forth, what that tends to potentially do to us is what I would refer to as a pigeonhole.

That pigeonhole could be somewhere that we get stuck because we don’t continually review our ICP and understand that. We’re going to talk about that a little bit more in a few minutes, so you know the other side of that is most products and ICPs are a chicken and egg.

We might have an ICP that we’ve identified, and we build a product, or we might have a product we want to build, and we build an ICP around that. We can consistently modify those and I want to chat about that a little bit further today as we go through this.

The last point of this particular slide is that there are blue oceans; if you have not read that ‘Blue Ocean’ strategy book, I highly recommend it.

You know, most of us, many of us spend a lot of time focused, and as I mentioned, pigeonholed into specific markets that we may know or understand, and there’s great life outside of that, and we’ll talk about what that really means.

So I’ll give you kind of an example of this, right? That depends on whose research you look at. There are 30,000+ SaaS companies out there right now, and it’s growing all the time. 17,000 of those are traditionally B2B SaaS companies, which I think most of us here are.

The challenge that I see and why I wanted to bring this topic up when Armando and I were first discussing this is really tied to the fact that there is this scenario in the world right now that we see that the vast majority of B2B SaaS companies are totally focused on selling the other B2B SaaS companies.

Is there anything wrong with that? Probably not; I mean, you could live in that model. What I’d like to suggest to you is that there is a world outside of that, and as this topic was titled ‘There’s a Plot Twist to that’, we could be thinking about this. Because there are potential challenges that come if we’re in that world of B2B SaaS selling to B2B SaaS.

Now, if you’re a founder, you might, just that’s what you know, maybe your executive team that’s what they know, maybe as we’ve seen over and over again in discussions, with you know peers of mine in the investment world that I talk to, is you see Angel groups, VC groups and even private Equity groups that are completely focused on B2B SaaS to B2B SaaS because that’s how they made their money. That’s what they know.

But I’m going to suggest that there are some options outside of that as well, so you know, as we talk about this, you know just if you looked at the channel, SaaS ecosystem alone, there’s 223 companies that are solely focused alone on B2B SaaS to B2B SaaS about channel products.

So, we can see that this model is what we live with and deal with every day. The challenge that we want to talk about here is that when we look at tech companies, their average, there’s this number of different statistics out there, but on average, tech companies spend about 350 dollars per month per employee on SaaS.

With that, non-tech companies, and this is that potential blue ocean, depending on what your product does, spend about 188 dollars. Well, you may first stop and think, ‘Well, that’s fantastic, this arena, Kevin. You’re full of it; why are you even talking about this?’

Is that the other side of that is that they spend more. The other side of that, though, is what we really want to talk about right that lower group of people there because of the risk that comes when you’re in a setting where your B2B SaaS to B2B SaaS, which is a very crowded marketplace, or any other crowded marketplaces that you might be in it’s compressed margins. We’ve got heavy competition; sometimes, pricing is a race to the bottom.

We could probably all think about a boatload of situations that’s happened. We struggle with the potential for lower ACV. We’ve got pricing battles that are going on. Companies will just say, ‘Well, we’ll just do a small test group because we’ve got a large IT department and we can Implement quickly,’ and then we’ve got this noisy landscape out there.

The second set of risks are lower lifetime value of the customer because we’re consistently seeing new competitors coming into that B2B SaaS to B2B SaaS world. Companies in the SaaS world or technology world. They are strong in technology because that’s what they do.

So, bringing a new solution isn’t hard for them. Bringing it whether it’s a new CRM or a new ERP or, you know, a new marketing automation tool. They can do that and get their data managed very quickly.

There’s price compression that happens in that arena, and then, of course, we face the risk of churn. There are lots and lots of options out there for products, and then that just denotes poor loyalty that comes from that, and we mention the ease of transition out of that.

So, in short, if you do some planning, some research, and even sometimes slight product tweaks, these ‘blue oceans’ can start to appear.

Where else can we sell this? Are there sub-markets? Are there new markets that we can be going after? New markets can overtake original ICPs. It gives us that opportunity to look at expanding our product offering, maybe even some product tweaks that can help us with that.

Then, we end up with great potential for growth. So, I want to give you our story briefly here.

What we did with our companies. We started our initial ICP with both technology companies and non-tech companies. What we identified, though, with a slight pivot in our product, we had a specific version of our product mostly for manufacturers, that we pivoted slightly to have an opportunity for wholesale distributors.

In our world, that meant dramatically higher user counts because most wholesale distributors have far more employees. We enhanced that product a little bit, we expanded around it, and we realigned how our market focus was to go after this new channel.

What did that produce for us? Last year, by going after this new channel, we had zero churn. Our contracts are longer, and our LTV has expanded. We do very little discounting in that setting because we’re not chasing others and racing to the bottom, and we’ve got loyal, raving customers that produce referrals and, more importantly with that, or as importantly, renewals.

So, the takeaway for us today is that we really want to be open to new opportunities. We want to make our ICP a living document for us. That is going to help us move ahead, and that, in fact, for us. So, ICPs are a living document.

Explore, Expand, and Pivot if you need to. Make some product adjustments that should accelerate growth. This last statement says that, sometimes, the only way to beat the competition is to stop trying to beat the competition.

So find those new arenas, adjust those ICPs if possible, and move ahead with your business.

So that’s it.

Hot Takes Live

Replays

Catch the replay of Hot Takes Live, where 30 of the top SaaS leaders across Marketing, Sales, and RevOps revealed some of their most unpopular opinions about their niche.

These leaders shared what lessons they learned and how they disrupted their industry by going against the grain (and achieved better results in the process).

Armando Biondi

Love it, Kevin, thank you so much.

It’s funny, Kevin because lots of today was around not defaulting to what everyone else thinks should be kind of the obvious answer, right? We talked about previously about other related topics similar to that, and you’re saying SaaS shouldn’t necessarily be your ICP, or like, why is that and what’s the decision framework around it?

Which I find very, very fascinating, by the way. It’s a very much active topic for us at Breadcrumbs as we speak.

Kevin Brown

Yeah, I think we’re creatures of habit, right? Path of least resistance.

Armando Biondi

Yeah, exactly.

Kevin Brown

That’s how we’ve always lived with that, and the way, Armando, that I’ve kind of looked at this is at the end of the day, we all have an altruistic side that we built a product that we strongly believe in, but the other side of it, in our case, our company is bootstrapped, it’s our money, we have to maximize that, and if we allow ourselves to stay in a place where we become stagnant.

I’m sure there are people who will either watch this live or watch the recording later and say, “Oh, you know what we were already doing that; we have our ICP, it’s a living document, and we review it monthly.” That’s great, but I’d say most companies probably haven’t looked at it in a long, long time because they’re busy.

Armando Biondi

I’m curious what your decision framework is to explore other ICPs/Industries. What would you recommend, like say that someone you know listening in and looking at the recording is like, “Oh yeah, maybe I should explore that idea. How should they do it?”

Kevin Brown

Well, so the first thing I throw out to you is a mindset. You have to adjust because we’re all you know; I mean, our product and our companies are like our children. So, the idea of a shift has to start with a mindset.

The second part of that is to be open to some what potentially might be minor product shifts. We had to do that; we had to build another version of our product to really get us to where we want it to be. Our development team and my co-founder Tom and his team did a phenomenal job of that.

But then literally, it’s like opening your mind and probably your fingers, of trying to, you know, do literally internet searches about other companies, and I’ll tell you they’ve never been in a better place for this than with the tools that we have with generative AI.

I mean, think about Chat GPT; you could literally go ask Chat GPT right now, ‘My product does this; it has these features. What other markets should I look at?’ and that’s going to start triggering…

Armando Biondi

That might be an example for inspiration, for sure.

Kevin Brown

Right, because that’s what most of us use chat GPT for inspiration to do other things lately.

Armando Biondi

Right, Yeah. Another way, it’s finally because my own Hot Take earlier today was around the fact that ‘Averages are a lazy AF way of measuring.’ And part of the story there is that if, instead of relying on averages, you do a cohort analysis and a more opinionated breakdown, there would be stuff that you expect to see.

There will be stuff that you didn’t expect to see. Like they would be outliers, there would be edge cases that might not be outliers but potentially point to future markets for you.

Kevin Brown

I mean, you could look at that similar point you could be looking at your Google Analytics. You could look at Breadcrumbs; you could look at whatever tools that you’re using in your business that lets you see who’s even looking at your website.

Instead of saying they’re not in our core ICP, stop and say could they be in our core ICP?

Armando Biondi

Why are they that interested in us if we’re not interested in that?

Kevin Brown

How did they show up here?

Armando Biondi

Exactly right.

Kevin Brown

They got here somehow. Why are they here, and did they spend any time? And if they spend any time, should I be thinking about the market that they’re in?

Armando Biondo

Is there something there for you? You can investigate.

Kevin Brown

And maybe even why did they move on past us? Am I missing something in my product that would have brought those people in?

What we found in our shift, Armando, which was really interesting in this, is that when we made a shift from, we started kind of focused on manufacturing and then tech companies, and we literally now kind of push tech companies off to the side just because of bandwidth and our team size.

But when we found it, I used the term earlier, and I moved pretty quickly though we talked about sub-markets, so we found some new sub-markets, but, I mean, they go deep, so we’re starting right now in like three or four arenas, and it’s probably 50.

We continue to grow, so this is kind of in our experience, and we could chat all day probably on this. I just wanted to kind of mention my contact information is here if anybody has an interest in talking. We host a podcast each week, and we actually talk about some of this type of stuff as well.

Armando Biondi

You were mentioning what, like, 17,000 B2B SaaS companies, like how many other companies are there in different markets than B2B SaaS, like, hundreds of thousands if not millions. Tom Burden, from the chat from the audience, is asking: Does this apply outside of B2B SaaS?

Kevin Brown

Yeah, well, a hundred percent. I don’t think it matters if… I mean, let’s look at the company you might be familiar with from your homeland that competed against Ferrari. Lamborghini, right? What did Lamborghini start making? Do you know?

Armando Biondi

I have no idea.

Kevin Brown

Lamborghini started as a tractor maker, I mean farming equipment, and he didn’t he didn’t like Enzo Ferrari.

Armando Biondi

And they’re like, ‘Wait a second, maybe I should start competing with this guy.’

Kevin Brown

So I mean, Tom’s point is, I think we could do this in any type of business. What attributes does my company have? What are we strong at? What if you’re in the manufacturing business what does our tooling allow us to do outside?

One of the best examples of that is, I think, that we could look at it. Just came to mind; look at all the companies that have, during the pandemic year, shifted their production.

My oldest son owns a clothing brand, a pretty popular clothing brand, in Los Angeles, and the next thing they knew, his clothing production lines were making masks with filtration in them because they partnered with a medical company to help them.

Armando Biondi

Kevin, thank you so much for being here.

Kevin Brown

Thanks for having me.